Invest Into Your Future

By investing in the Extension Fund, individuals directly contribute to the growth and development of Church of God by Faith ministries.

This aligns with the values of those who believe in supporting their faith community.

Some key benefits when you invest with us:

- Customizable Loans: The Extension Fund provides capital for customizable loans that suit the needs of ministry growth and change.

- Earned Interest Rates: Investments are offered at annual percentage rates.

- Flexibility: Investors can choose from various investment terms.

Get started with as little as $250!

Advantage Certificate

Available to COGBF Members

Minimum initial investment of $250.00

Youth Custodial Account

No term

For COGBF Members up to age 18

Minimum initial investment of $100.00

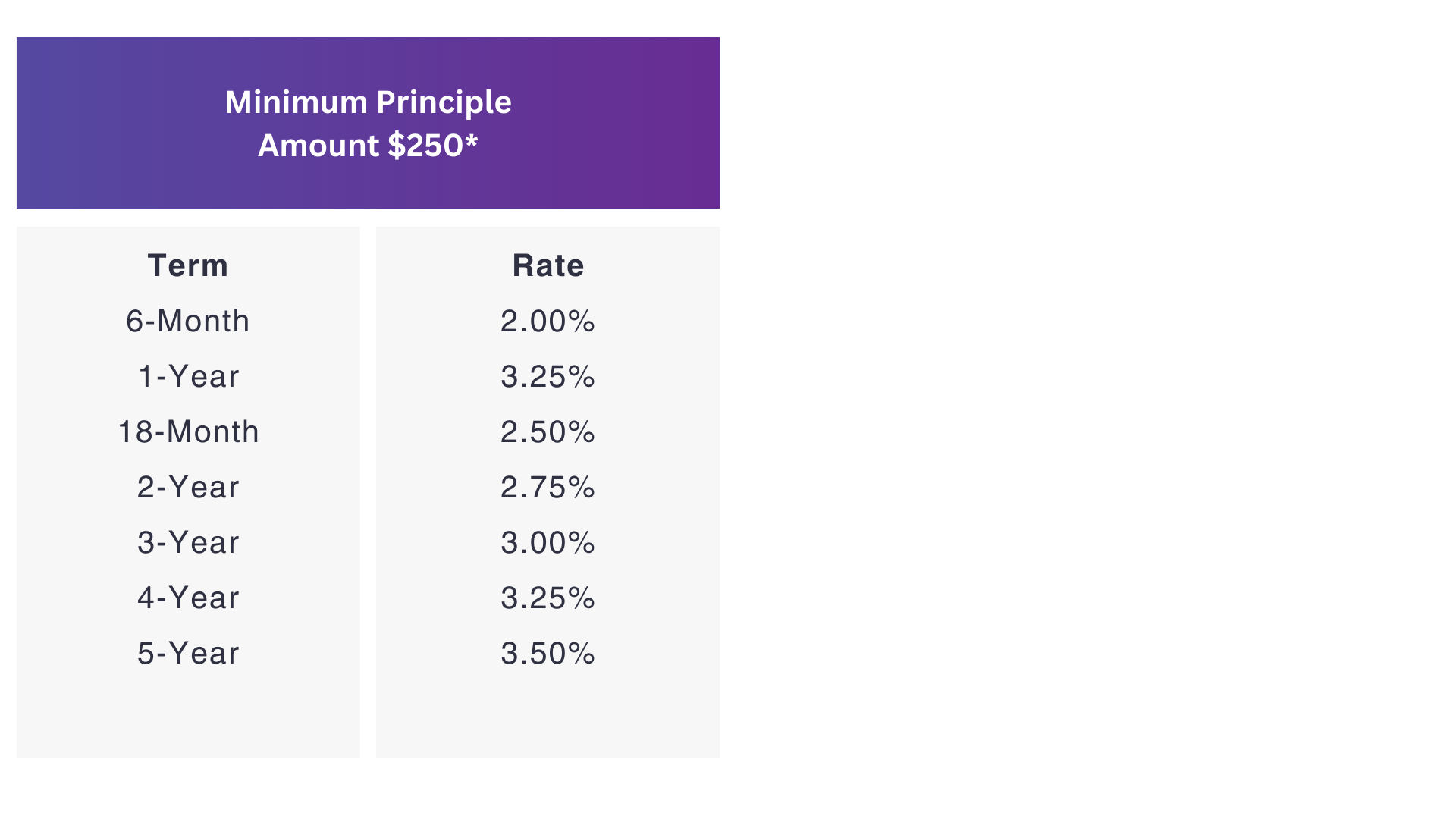

Time Certificate

Minimum initial investment of $250 is required.

Penalties for early withdrawals.

Retirement Account

Rollover of qualified employer based retirement plans (401K, 457)

Start new IRA’s and Roth IRA’s

Minimum initial investment of $2,000 is required.

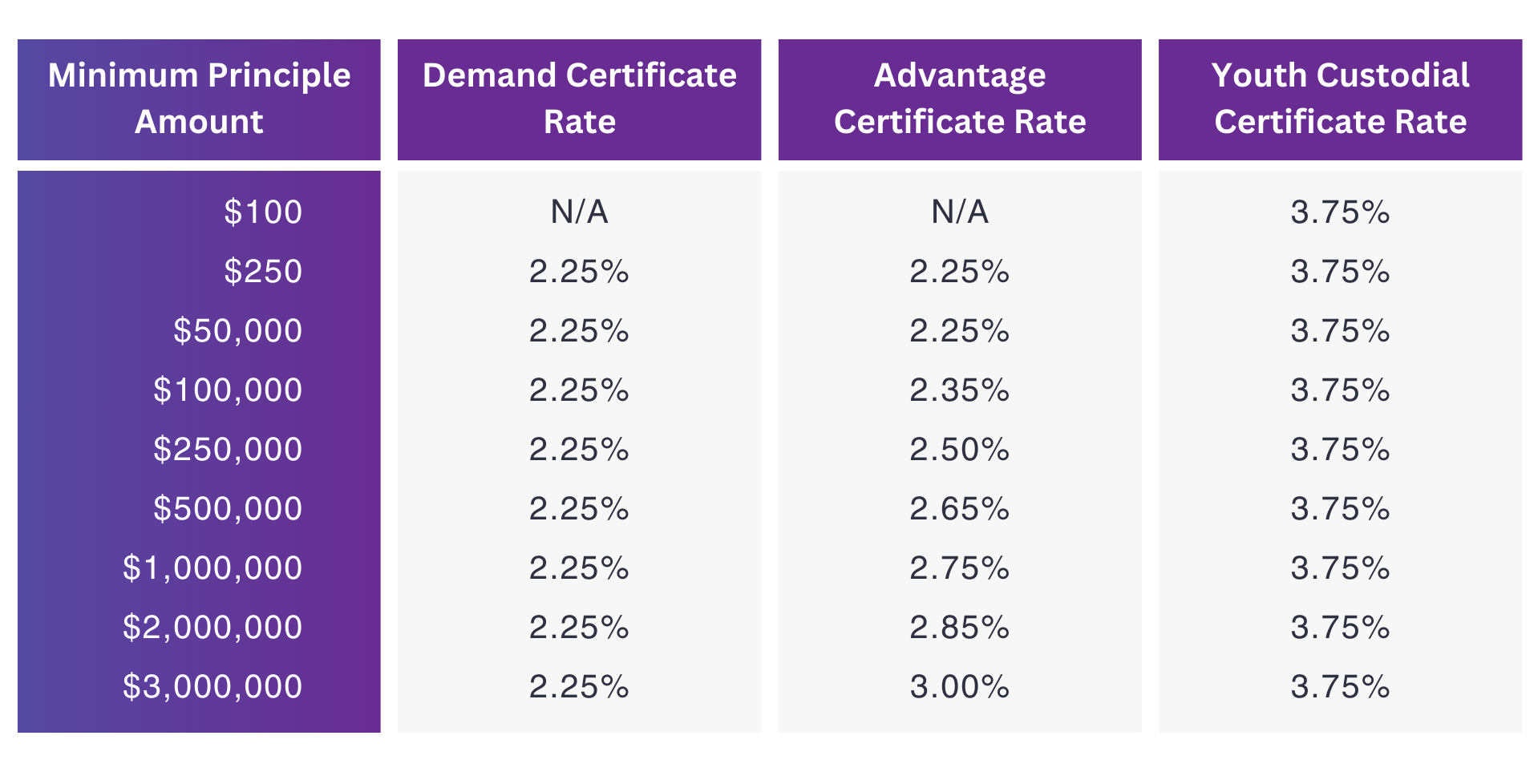

Demand, Advantage, and Youth Custodial Certificates

Time Certificates

*Minimum Principal Amount for Time Certificates purchased by new retirement accounts is $2,000. Please contact our office for purchases by retirement accounts. $100-dollar minimum is available for “Youth Custodial Certificates” only.

Rates as of date stated, subject to change. Penalties may apply to redemption prior to maturity. This is not an offering to sell securities referred to herein and we are not soliciting you to purchase these securities. The offering is made only by the Offering Circular which includes risk factors. The Offering Circular may be obtained by writing or calling COGBF Financial Solutions or by logging onto COGBFFS.ORG. An investment in COGBFFS involves certain risks that other investment options may not have. Not all risks can be quantified or compared to other investments. You should carefully evaluate all the risks in assessing the potential benefit of the various investments. COGBFFS investments are offered and sold only in states where authorized. Not FDIC or SIPC Insured. Not a Bank Deposit. No COGBF guarantee.

Frequently Asked Questions

You are eligible to invest if you are a member or a lifetime member of COGBF, the denomination. Or if you are a family member of a COGBF member. Please ensure that you are within the nineteen states where we do business; review our “Investment” page. Read our “Offering Circular” and then go to our “Forms” page and select the application type that fits your need. We have applications for Ministries and Corporate, Individuals and Families, and Minor/Youth Custodial Accounts. You’ll then need to complete the Electronic Funds Transfer form whether you’re sending a check or allowing us to draft the funds from your bank account. Once all forms are printed, review, complete, and return the application and electronic funds transfer form to Financial Solutions via fax, email, or mail. All first-time investors must physically sign the application and EFT.

Certificate investments are available exclusively through our offering circular as either termed or demand certificates. Termed investments are committed for a specific period with a fixed interest rate, terms are 6-months up to 5-years. Demand certificates don’t have a term and the rate can vary. Please visit our “Investment Page” to see our rates and terms. The rates and terms for termed investments are the same for our Individual Retirement Accounts.

We have the flexibility to pay investors their interest as they choose. We can pay the interest quarterly, semi-annually or annually. The investor can also choose to reinvest any earned interest until the investment matures.

Interest is compounded quarterly for all investments. Compound interest is calculated on the initial principal and on the accumulated interest from previous periods. Making your money count. We can pay the interest quarterly, semi-annually, or annually. The investor can also choose to reinvest any interest earned until the investment matures.